New Jersey Payroll Guide: Step-by-Step Teachings for Small Businesses

Sep 02, 2024 By Sid Leonard

NJ taxes everyone's wages as state income. Employers deduct taxes and unemployment insurance from workers' salaries every three months. However, one of the most crucial talents a New Jersey small company owner can have is tax preparation.

Selecting a payroll plan and setting up a payroll system may seem daunting. In this case, an HR manager can handle payroll, or you may learn about it yourself and save some money. However, you can utilize an internet payment service or engage an accountant to conduct the tedious small company billing payroll. Nonetheless, handling payrolls is important and might seem difficult at first. But dont worry, were here to guide you right through it.

Laws For Minimum Wage in New Jersey

The minimum pay in New Jersey right now is $15.13 an hour, and tip-based workers get $5.26 an hour. If the state's CPI goes up, the minimum wage will go up too. The following are exceptions to the rule:

- University-employed full-time students earn 85% of the minimum wage.

- Outside salespeople are exempt.

- Part-time child caregivers in homes are exempt.

- Minors under 18 who are employed in specific jobs are exempt.

- Nonprofit summer camp workers are exempt from June to September.

Paycheck Deduction Rules

In New Jersey, payroll financing deductions are only allowed in certain cases and when permitted by law or a collective bargaining agreement.

- Retirement payroll financing

- Profit-sharing

- Union fees

- Health insurance

- Thrift plans

- Employer loans

- Employee savings

- Charity Donations

- Childcare services

- Hospitalization

- Uniform rental/cleaning

- Health club fees

- Product purchases

- Worker welfare

Steps For Payroll In New Jersey

Obtain Federal EIN

Your company needs an EIN to become an employer. You need your IRS-issued nine-digit number for taxes. Your new company needs an EIN, which you can receive online from the IRS. You must also maintain an EIN on file to submit federal tax forms. Moreover, if your firm has an EIN, have it on hand for employer tax forms and billing payroll procedures.

Register with New Jersey

Once you have your EIN, the next step is to your business with the New Jersey Division of Revenue and Enterprise Services. To do this, you need to fill out the NJ-REG tax/employer registration form and the proof of formation for your business.

Moreover, you need to finish this filing to establish your company in the state and meet your state's tax obligations. Setting up your salary and tax reporting duties in New Jersey may be easier if you do it all online with assistance from payroll coordinators.

Set Up Payroll

Setting up a reliable payroll process is necessary for managing employee pay. To begin, set a normal date for your next paycheck. Even if your boss gets paid once a month, you still have to pay them at least twice a month. Make sure that the state's rules about overtime are being followed.

Moreover, making payroll financing by hand is possible but not recommended because mistakes could happen. Consider using Excel files or specialized salary tools to get calculations done automatically and with confidence. Also, billing payroll software may help you comply with tax reporting and payment laws.

Employee Payroll Forms

Getting and keeping track of salary information for new employees is an important part of training. The I-9, which proves you can work at the job, the government W-4 for tax payments, and the direct transfer information are all important pieces of paper.

Moreover, people from Pennsylvania who work in New Jersey may also need to fill out the NJ-165 form to ensure they get their state taxes correctly credited. People who work in New Jersey must also fill out the NJ W-4 form. Legal requirements and correct tax deductions monitored by payroll coordinators require that these forms be filled out correctly and on time.

Review Time Sheets

You need to keep accurate time records to handle salaries accurately. At the end of each pay month, all employee time sheets are collected, reviewed, and approved. Employees should also write down their hours worked and any extra on time sheets.

You can use digital time and attendance tools or paper forms to keep track of them. By quickly reviewing these numbers, you can find and fix mistakes before the salary is filled out. Having employees sign their time sheets is a great way to ensure they are correct.

Payroll Calculation

The salary needs to be worked out after the timesheets have been checked. First, find out how much an employee makes before taxes, insurance, and retirement contributions are taken out. This gives you their net payroll financing fund.

Usually, the numbers for salaries can be entered by hand or on a computer using an Excel file, but billing payroll software is faster and more accurate. You won't have to worry about breaking the tax rules when you use such tools; it will do all the math for you.

File Payroll Taxes

It is the law that companies in New Jersey must file their wage taxes with both the federal and state governments on time and correctly. Make sure you follow the IRS's rules for Social Security, Medicare, jobless, and withholding when you file your federal taxes. You can use EFTPS to file them.

Moreover, many businesses in New Jersey have to file their state income tax and unemployment insurance forms with payroll coordinators. The WR-30, NJ-W3, and NJ-927 are important forms for getting unemployment insurance.

Record Requirements

New Jersey law requires businesses to preserve comprehensive compensation records for six years. These documents should contain the employee's name, contact information, hours worked, remuneration, adjustments, and date of birth if the employee is under 18.

State labor rules and examinations require accurate record-keeping. Consider digital storage for these documents to keep them secure and simple to discover. A payroll coordinator should regularly verify and update records to ensure legal compliance.

Annual Tax Reports

Year-end billing payroll tax returns are due from employers. This includes federal paperwork like the W-2 for workers and the 1099 for freelancers. New Jersey employers must also provide workers with the NJ-W3-G. It lists their annual gross taxed salary. The state and IRS use this information to calculate taxes and to avoid penalties for inaccuracies.

How to Create a Roth IRA Backdoor

Prequalified vs. Preapproved: Learn the Difference

New Jersey Payroll Guide: Step-by-Step Teachings for Small Businesses

Plan For Your Retirement With The 4% Rule

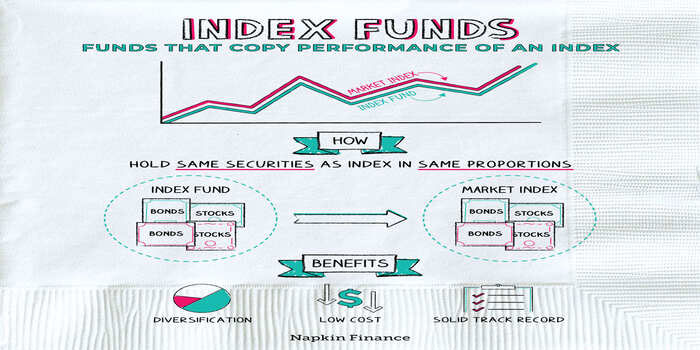

Top 3 Index Funds For Investors With A Long-Term Perspective

How exactly does Eventbrite make money?

Explain in Detail: Why Invest In Index Funds?

Way to Estimate Your FICO Score

Webull Review 2024: Free Trading App for Beginner and Pro Investors

How To Perform A Credit Check On A Potential Tenant

National Debt Relief