Plan For Your Retirement With The 4% Rule

Feb 15, 2024 By Triston Martin

Retirement is when you can enjoy life without worrying about bills or other financial obligations. The sooner you start saving for retirement, the better off you'll be, as it will help you to build up your nest of solid eggs. If you wait until later in life, you might not have enough saved.

Importance of Having a Retirement Savings Plan

Retirement planning is important for everyone, especially those not yet ready to retire. A retirement savings plan can help you save for your future and ensure you have enough money to live on when you retire.

Retirees face many challenges in retirement, such as finding affordable housing, managing expenses, and securing a reliable income. A retirement savings plan can help alleviate some of these challenges.

Not many people in this world would love to work after age 65, so a retirement savings plan can provide a stable source of income for them during retirement. All retirees aim to live a comfortable life, and this retirement savings plan can help them maintain a sense of independence and control over their lives.

How to Create a Retirement Savings Plan

There are a few steps that you should accomplish to create a successful retirement savings plan.

Firstly, start by creating a budget and mapping out your monthly expenses, as this will help you identify how much you need to save each month to have a comfortable retirement. Then the second step that you should do is to calculate your annual contribution limit based on your salary and health insurance premiums. Finally, you are ready to open a retirement savings account and make your first contribution.

Always remember that your responsibility does not stop here; it is essential and recommended to review your plan and make adjustments as needed. Your income may increase or decrease, so you could have to act smartly in these situations. Lastly, stay on track and keep your retirement savings grow.

How Much Money Should You Have?

When it comes to retirement, most people think about how much money they need to save to cover their costs in retirement. But how much should you have saved?

There is no specific number that will answer this question. It depends on your income, age, lifestyle, and many other factors. For example, if you are 67 years old, you should have at least ten times your annual income in your bank. These number changes as your age decrease; for an individual of age 50

But overall, experts suggest that you should have enough money saved to cover at least three to five years of living expenses.

Try The 4% Rule!

If you are unsure how much you should have saved, try calculating your estimated retirement expenses using the retirement calculator. Another great and easy way to calculate retirement savings amount is the 4% rule.

The 4% rule divides the desired annual retirement income amount by 4%. So, if your aim is $100,000, your retirement nest egg should be $2.5 million ($100,000/0.04).

The 4% rule considers a 5% investment return. This is the amount after deducting the taxes and taking the impact of inflation. It doesn’t include any additional retirement income like your current lifestyle or social security.

The 4% rule assumes 30 years of life in retirement. So people who live longer than 30 years after retirement needs longer portfolios covering the added medical costs and other expenses with age.

How to Maximize the Returns on Your Retirement Savings

Maximizing your savings on retirement can significantly boost your retirement planning.

The first step towards maximizing your returns will be the growth plan. You will write everything you want to accomplish and how to help you do that. You will have to be disciplined with your investments, and if you miss saving every month, you will have to face the consequences in the future.

Diversifying your investments becomes very important as it will help you achieve better results. This means you don't have to put all your eggs in one basket but invest in different investments to maximize your returns.

You must ensure your retirement account is FDIC insured to protect your money if something happens to your employer or the stock market. You can analyze different retirement account options, as many offer unique features that can help you save more money.

How to Reduce the Risk Associated with Retirement Savings

Considering retirement, it is essential to consider all the potential risks. One of the biggest risks when it comes to retirement savings is that you might not have enough money saved up, and there are a few steps to follow to prevent that.

You should ensure you are investing your money wisely and aware of potential retirement risks, such as Social Security and estate taxes. You may get relatively less money than you have expected, so it is essential to talk to a financial advisor about your options, as he can help you figure out what is best for you and your retirement savings.

Final Thoughts

Retirement savings are essential for the future because they provide a cushion against unexpected financial challenges.No matter what you think about retirement savings, you must accept that this is a thing you should work on in your life.

Finally, ensure retirement savings are invested in providing the best return over the long term.

How exactly does Eventbrite make money?

Webull Review 2024: Free Trading App for Beginner and Pro Investors

TimeTrex 2024 Review: Is It the Right Workforce Management Tool?

Callable CDs: A Deep Dive Into This Unique Investment Option

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

Prequalified vs. Preapproved: Learn the Difference

Sears Shop Your Way Mastercard Review

Types of Termination Letters and Essential Inclusions for Employers

Apple's Financials

Investing in The 10-Year U.S. Treasury Notes: Its Benefits and Phases

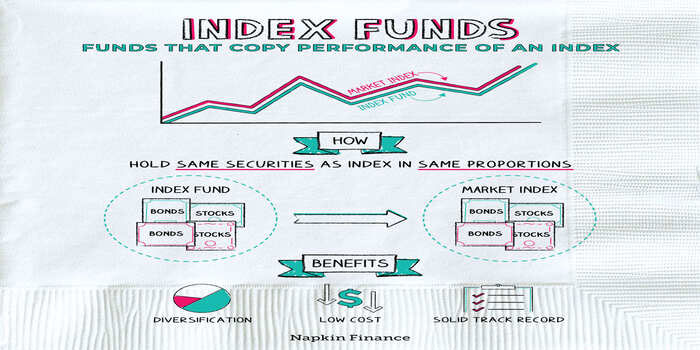

Explain in Detail: Why Invest In Index Funds?