How to Create a Roth IRA Backdoor

Oct 27, 2023 By Triston Martin

Those who earn a lot of money can't contribute to a Roth IRA directly. Because of a loophole in the tax code, they can nevertheless make indirect donations. You may save tens of thousands of dollars in taxes over the years if you take advantage of and optimize your retirement savings. Take a closer look at creating a Roth IRA through the back door and the benefits.

What Is a Roth IRA "Backdoor"?

The federal government does not recognize individual retirement accounts known as "Backdoor Roth IRAs". When it comes to high-income taxpayers, though, it's an informal term for a sophisticated strategy that allows them to open and maintain tax-free Roth IRA accounts regardless of income levels.

Conventional IRAs and Roth IRAs are both available through brokerages and financial firms, which may assist investors with the process of converting a traditional IRA to a Roth IRA. This is not a tax avoidance strategy. Taxes are due in the year in which you move traditional IRA assets to a Roth IRA on any untaxed cash, as well as on any profits and asset appreciation in the transferred assets. I

Why Use a Backdoor Roth IRA?

Tax-free growth is possible in both Roth and regular IRAs. On the other hand, Roth IRAs have certain benefits over standard IRAs. There are no mandatory minimum distributions in place (RMDs). As long as you desire to keep your money in your Roth, it can continue to grow eternally.

The ability to use your Roth IRA as a gift or an inheritance may be helpful to you if you plan to have adequate retirement income from another source, such as a 401(k). Recordkeeping and tax preparation are both facilitated by the absence of RMDs. In retirement, when you'd rather be relaxing and having fun, it'll save you a lot of hassle and time.

It is also important to note that Roth distributions, including earnings from your contributions, are not taxed. Roth contributions are taxed at a lower rate because future tax rates may be higher than current. Therefore some persons want to pay taxes on their retirement plan contributions rather than their payouts (k). Some people want to have a foot in both the pre-and post-tax worlds, so they contribute to their plans in both ways.

How to Make a Roth IRA Through the Back Door

Those with a modified adjusted gross income (MAGI) of $125,000 will face lower Roth IRA contribution amounts starting in 2021. Those who earn more than $140,000 are no longer able to contribute. It's worse for married taxpayers because their restrictions aren't twice those of single taxpayers.

The MAGI of $198,000 marks the beginning of a phase-out of their capacity to contribute, ending at the MAGI of $208,000. A slight increase is expected in 2022. The phase-out range for individuals is between $129,000 and $144,000. It rises from $204,000 to $214,000 for married couples filing separately. People with greater earnings can contribute to a conventional IRA without restriction. This is a weakness exploited by the backdoor Roth.

· Step 1: Contribute to an IRA

You can donate the difference if you earn less than $6,000 in 2021 and 2022. For a non-working (or low-income) spouse, the working spouse can contribute an additional $6,000, as long as the aggregate contributions of both spouses (up to $12,000) do not exceed the working spouse's earnings. If both spouses are 50 or older, they can each contribute an additional $1,000 in catch-up contributions every year, resulting in a combined total of $14,000 in their conventional IRAs for 2021 and 2022.

· Step 2: Convert Your Traditional IRA to a Roth

Why do you need to take this action now? It's possible that if you leave the money in your traditional IRA, you'll be taxed on any interest or dividends that accrue. To avoid paying taxes on an excess contribution, you should only convert your total account balance after earning a sufficient amount. After the conversion, any untaxed funds in the conventional IRA will be subject to taxes. Please keep it simple: Don't put off making the switch.

· Step 3: Repeat the Process

Make use of the backdoor Roth every year that you cannot contribute to a Roth IRA in full through the usual front-door method.

Backdoor Roth IRA Advantages

Why would taxpayers bother with the additional procedures required to do the Backdoor Roth IRA dance to get around the constraints? There are several valid reasons for this. There are no minimum distributions (RMDs) in a Roth IRA, so the account holder can enjoy tax-deferred growth of their account balances for as long as they can do so. Take what you need, when you need it, or leave it all to your heirs if you like. Because Roth IRA distributions are not taxed like regular IRA payouts, a Backdoor Roth contribution can result in considerable tax savings over time.

Is a Roth IRA Backdoor Legal?

Under current law, backdoor Roth IRAs are lawful and respected by the IRS as long as tax law standards are followed. Build Back Better's present form would limit pre-tax donations to 2022 if adopted in its current form. The expansion of high-value accounts for high-income taxpayers will be limited beginning in 2029. High-income persons will be exempt from conversions starting in 2032. To qualify as a "high-income taxpayer," an individual must have a modified adjusted gross income (MAGI) that exceeds a particular threshold.

Why Open a Roth IRA Backdoor?

A Roth IRA Backdoor even if you make too much money to qualify for one, may still be worth it if you want to avoid paying taxes when you finally take the money. If you intend to be in a higher tax rate in the future, this is very helpful. Even if you can't use the Roth IRA yourself, you can choose a beneficiary to receive the funds after you die.

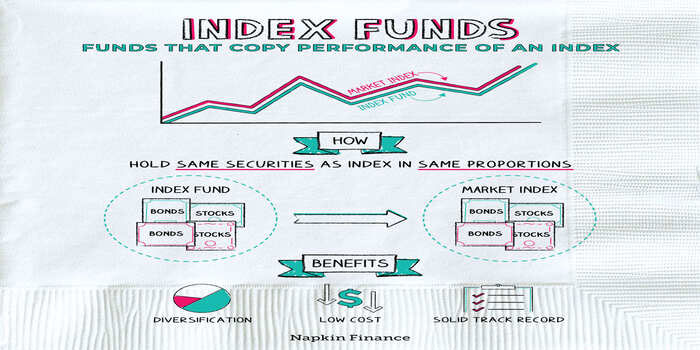

Explain in Detail: Why Invest In Index Funds?

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

Investing in The 10-Year U.S. Treasury Notes: Its Benefits and Phases

How Long Should You Live in a House Before Selling

Apple's Financials

Regulation E Guide: Fraud and Error Protection for Your Money

Way to Estimate Your FICO Score

How Does a USDA Loan Work

Top 3 Index Funds For Investors With A Long-Term Perspective

TimeTrex 2024 Review: Is It the Right Workforce Management Tool?

New Jersey Payroll Guide: Step-by-Step Teachings for Small Businesses