Webull Review 2024: Free Trading App for Beginner and Pro Investors

This article provides a detailed Webull review 2024 to discuss the features and benefits of using the free trading app

Plan For Your Retirement With The 4% Rule

The easiest way to determine the amount for your retirement savings is the 4% rule. It’s a simple formula where you divide desired annual retirement income by 4%.

A Beginner's Guide to Corporate Bonds: Definitions and Purchase Tips

Corporate bonds are debt securities companies issue to raise capital. Investors can buy them through brokers, providing a fixed income with potential interest payments.

TQQQ vs. QQQ

While these ETFs all follow the same index and have identical ticker symbols, there are some key distinctions between them that you should be aware of before you invest.

Apple's Financials

Apple Inc. is a global technology company that develops, manufactures, and sells smartphones, personal computers, tablets, wearables, and other accessories. The most popular items include the iPhone and the Mac series of laptops and computers, as well as its iPad, Apple Watch, and Apple TV. Apple also operates an expanding services business, including its cloud service and streaming of digital content like Apple Music and Apple TV+. The latter was introduced in November of this year.

How exactly does Eventbrite make money?

A wide variety of events occur each year, including concerts, marathons, talks, hackathons, air guitar competitions, conferences, political rallies, and gaming tournaments. Advertise, plan, and sell tickets for an event all through the same social e-commerce platform. It also makes it possible for consumers to find these events and buy tickets.

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

For seasoned traders, both TD Ameritrade and Interactive Brokers are reliable choices. To assist you in choosing the best broker for you, we'll look at how to compare the two brokers side by side below.

Ways To Build A Bond Ladder To Boost Returns

Portfolio managers often bring up risk diversification and effective money management when discussing successful methods. Don't get the wrong idea: having a little luck isn't always bad.

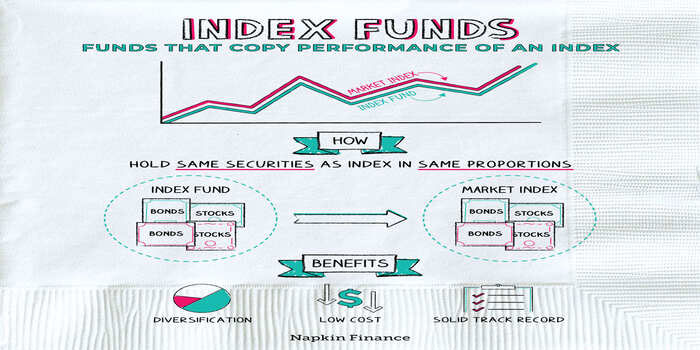

Top 3 Index Funds For Investors With A Long-Term Perspective

The finest index funds may aid wealth accumulation by providing portfolio diversification at a low cost. Since financial institutions often own hundreds of securities, investing in one carries far less risk than investing in individual securities or bonds. Investing inside an index fund, whose risk is dispersed throughout several firms' stocks and bonds. You may easily and cheaply diversify your exposure to U.S. equities by purchasing shares in a whole index fund of stocks. Fund. Generally speaking, the funds have very low expense ratios. However, not all choices are created equal; several indexes and approaches are used by various options to simulate the performance of the NYSE. Total indexes of stock funds are suitable for a deductible brokerage account and are a great option for diversifying a retirement portfolio because of their low taxes.

Investing in The 10-Year U.S. Treasury Notes: Its Benefits and Phases

Investors may bid competitively or non-competitively for 10-year US Treasury notes during auctions. Read more.

Explain in Detail: Why Invest In Index Funds?

Investors favor index funds due to the low fees, broad exposure to the market, and the reduced risk they provide. Many people, especially newer investors, think index funds are better than buying individual stocks. Rather than purchasing the index itself, you can invest in a fund that tracks it. Both mutual funds and exchange-traded funds (ETFs) account for the vast majority of index investments.

The Sharing Economy

Airbnb is a service that allows people to rent their main homes as accommodation for tourists. Most renters seek accommodation with a homey atmosphere which hotels cannot offer, while hosts would like to let their homes increase their income. Most of the revenue comes from the service fee for bookings that are charged to guests and hosts.

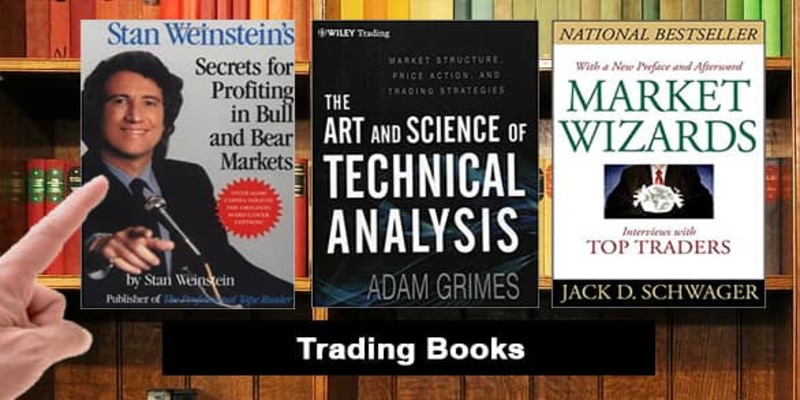

Top 4 Best Commodity Trading Books Of 2022

We've compiled a selection of helpful commodities books for newcomers, covering topics such as how the market works, how to trade profitably, how commodity futures work, how the market may develop in the future, and how to mitigate risk. What follows is a catalog of such a publication's goods.

How to Create a Roth IRA Backdoor

The federal government does not recognize individual retirement accounts known as "Backdoor Roth IRAs". When it comes to high-income taxpayers, though, it's an informal term for a sophisticated strategy that allows them to open and maintain tax-free Roth IRA accounts regardless of income levels.

What's A Fee-Based Investment?

A financial product or service provided by a bank or other financial institution for which a fee rewards the adviser in addition to a commission is referred to as a fee-based investment. One of the price structures that a financial expert can use is based on fees.