How To Perform A Credit Check On A Potential Tenant

Feb 22, 2024 By Triston Martin

Tenant screening processes that include a credit check may assist landlords in choosing responsible occupants for their rental properties after an applicant has completed a rental application. There is no easy path to success as a landlord. How to Run a Credit Check on a Tenant That Your primary focus should still be on finding a reliable renter who can pay you on time for your home's rental. Running a tenant's credit might help you obtain your rent on schedule. A thorough background check should verify your prospective tenant's application details. Furthermore, a credit check may help you identify reliable tenants and enhance company screening. So, let's get going with the basics.

What Is Information Required For A Tenant Credit Check?

Before doing a credit check, you need a prospective tenant's written authorization and compliance with the Fair Credit Reporting Act. A paper indicating the tenant's agreement to the credit check must be signed and dated. At the end of the Application Form, numerous landlords include this provision. If your Application Form doesn't give you express permission to check a renter's credit, you'll need to have the tenant sign another document permitting you to do so.

Determine Whether You Will Charge For Credit Checks

Since applicants with low credit histories are unlikely to agree to pay an application fee, such as $15, numerous landlords find that doing a credit check as part of the application process saves them money. Some landlords don't charge a fee because they believe that charging a price would prevent even excellent renters from seeking to rent their homes. You may also subtract the amount from the first month's wages or add it into the bank guarantee if you want to charge the fee and the renter decides to move in. Finally, to ensure that applicants are serious about renting from you, you may only run credit checks on those who submit a security deposit and full application.

Execute A Credit Check

There are several tenant screening services available to landlords, including Experian, E-Renter.com, as well as Mr Landlord.com. You may find a lot of additional choices with a quick internet search. Don't just blindly hand up your personal information; first, verify that they are a reputable organization. You are trusting them with personal and financial details that might make you directly responsible for fraud in your or your potential tenant's name if the information falls into the wrong hands. A landlord but a real estate agent may impose an application fee in addition to any other fees associated with the application process if a credit check is required.

Rejecting A Person With Poor Credit

You are required by Fair Debt Collection Practices act to adhere to a specific set of steps in the event that a potential tenant's credit rating contains unfavorable information and you decide not to lease to them solely because of their credit history. In this scenario, the prospective tenant's credit report would be considered to have negative information. These procedures are a legal necessity.

First, send the prospective renter an "Adverse Action" letter stating why their application was denied. You must specify why you were rejected. They should also be informed that they have the right to receive a complimentary copy of their bank statement from the agency they employed to run the report within 60 days and given the company's name, address, as well as a phone number.

Conclusion

Conducting a background check yourself is the most cost-effective option. Credit checks, background checks, and eviction reports may be expensive to do yourself, costing anything between $19.99 to $34.99 for the first renter and additional for each successive tenant. Running a credit check independently may be free of charge if you're prepared to invest the time and necessary effort. The hardest part is reading the credit check; the rest is just knowing what and how to look for. Tenant screening processes that include a credit check may assist landlords in choosing responsible occupants for their rental properties after an applicant has completed a rental application. There is no easy path to success as a landlord.

Types of Termination Letters and Essential Inclusions for Employers

Everything you Need to Know About Indirect Loans

A Guide about Alliant Credit Union Personal Loans

Apple's Financials

Sears Shop Your Way Mastercard Review

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

Prequalified vs. Preapproved: Learn the Difference

AmEx Gold vs. Platinum: Which Is Better for Your Business?

Which Mortgage Type Should I Choose?

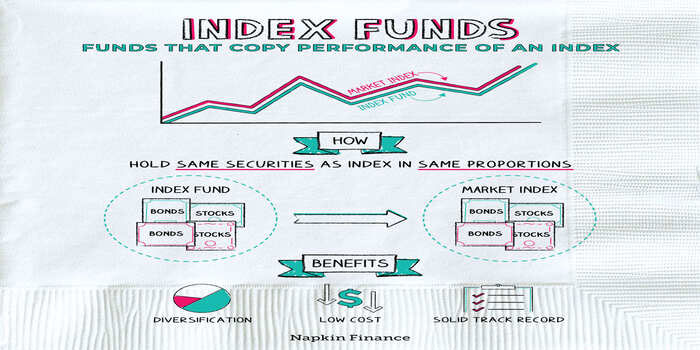

Explain in Detail: Why Invest In Index Funds?

Top 3 Index Funds For Investors With A Long-Term Perspective