Prequalified vs. Preapproved: Learn the Difference

Oct 05, 2023 By Susan Kelly

If you're in the market to buy a home, you've likely encountered the terms "prequalified home loans" and "preapproved" when it comes to home loans. While they may sound similar, they serve different homebuying purposes. Understanding the distinction between these concepts is crucial as you embark on your journey to homeownership.

This comprehensive guide will break down the differences between prequalification and preapproval, helping you confidently make informed decisions and navigate the home loan process.

Prequalification: The Initial Step

If you are curious about prequalification home loans, then keep reading!

What is Prequalification?

Prequalification is the first step in the home loan process. It's a preliminary assessment of your financial situation conducted by a lender. During prequalification, you provide basic financial information to the lender, such as your income, assets, debts, and credit score. Based on this information, the lender estimates the loan amount you might qualify for.

Key Points to Remember

- Prequalification is typically a quick and straightforward process.

- It does not require a thorough review of your credit report.

- The estimate provided is not a commitment from the lender to provide a loan.

- Prequalification is often done online or over the phone.

Benefits of Prequalification

Understanding Your Budget: Prequalification is a valuable tool that provides insight into the price range of homes within your financial reach, allowing you to make informed decisions about your housing options.

Initial Guidance: It offers guidance on what you can afford, giving you a starting point in your home search. Additionally, it helps you make informed decisions about your budget.

Competitive Advantage: Some real estate agents may require buyers to be prequalified before showing them homes, giving you a competitive edge in a competitive market.

Preapproval: A Deeper Dive

If you are curious about preapproval loans, then you can scroll down!

What is Preapproval?

Preapproved is a more in-depth process than prequalified. It involves a comprehensive review of your financial history and creditworthiness by a lender. To get preapproved, you must complete a formal mortgage application and provide the necessary documentation, including income statements, bank statements, tax returns, etc. The lender will also obtain your credit report during this stage.

Key Points to Remember

- Preapproval requires documentation and a credit check.

- It provides a conditional commitment from the lender to grant you a specific loan amount.

- Preapproval typically has a more extended validity period compared to prequalification.

Benefits of Preapproval

Stronger Offer: A preapproval letter demonstrates to sellers that you are a serious and qualified buyer, potentially strengthening your offer's credibility.

More evident Budget: With preapproval, you have a more accurate understanding of your budget, helping you narrow your home search and make informed financial decisions.

Faster Closing: Preapproval can expedite the closing process since much of the required documentation has already been reviewed, allowing for a quicker conclusion to the transaction.

Negotiating Power: Sellers may be more inclined to negotiate with preapproved buyers because they are seen as less risky. Additionally, being preapproved demonstrates a buyer's financial readiness and seriousness, potentially granting them an advantage in negotiations.

The Key Differences

Let's summarize the main differences between prequalification and preapproval.

Prequalification

Informal Assessment: It's an informal estimate of your loan eligibility.

Basic Information: Requires basic financial information.

No Credit Check: Typically, it does not involve a credit check.

Quick Process: Generally a faster process.

Preapproval

Formal Evaluation: It's a formal evaluation of your creditworthiness.

Extensive Documentation: Requires extensive financial documentation.

Credit Check: Involves a credit check.

Conditional Commitment: Provides a conditional commitment from the lender.

When to Use Each?

Are you often left perplexed and uncertain about which option to select for the most favorable outcome? If so, rest assured, as the following context will provide you with the guidance needed to decide!

Prequalification

Use prequalification when you're in the early stages of considering homeownership. It helps you gauge your budget and gives you a rough idea of what you can afford. Prequalification is often used to:

- Set a preliminary budget for your home search.

- Get a sense of whether homeownership is financially feasible.

- Quickly assess your eligibility without an extensive documentation process.

Preapproval

Use preapproval when you're serious about buying a home and ready to start the formal homebuying process. Preapproval is typically employed to:

- Strengthen your offer when making an offer on a property, demonstrating to sellers that you're a committed buyer.

- Gain a competitive edge in a highly competitive real estate market, positioning yourself as a strong and reliable contender.

- Expedite the closing process by having much of the necessary documentation prepared, streamlining the overall transaction and minimizing delays.

The Importance of Credit

Whether you're seeking prequalification or preapproval, your credit history plays a vital role. Lenders use your credit score and credit report to assess your creditworthiness. It's crucial to:

- Maintain good credit habits.

- Review your credit report for inaccuracies.

- Avoid making significant changes to your credit profile during the home-buying process.

- Stay vigilant and promptly address any suspicious activities or unauthorized inquiries on your credit report.

Conclusion

In the homebuying process it’s important to understand the core difference between the two. While prequalified provides a general idea of your budget, the preapproved offers a more solid commitment from the lender and can give you a competitive advantage when making home offers.

Both have their place in the homebuying journey, with prequalified being an excellent initial step and preapproved being a crucial milestone when you're ready to make your dream of homeownership a reality.

On this page

Prequalification: The Initial Step What is Prequalification? Key Points to Remember Benefits of Prequalification Preapproval: A Deeper Dive What is Preapproval? Key Points to Remember Benefits of Preapproval The Key Differences Prequalification Preapproval When to Use Each? Are you often left perplexed and uncertain about which option to select for the most favorable outcome? If so, rest assured, as the following context will provide you with the guidance needed to decide! Prequalification Preapproval The Importance of Credit Conclusion

Ways To Build A Bond Ladder To Boost Returns

How exactly does Eventbrite make money?

Apple's Financials

AmEx Gold vs. Platinum: Which Is Better for Your Business?

How To Get A Mortgage Refinance Even If You Have Bad Credit

Top 4 Best Commodity Trading Books Of 2022

What's A Fee-Based Investment?

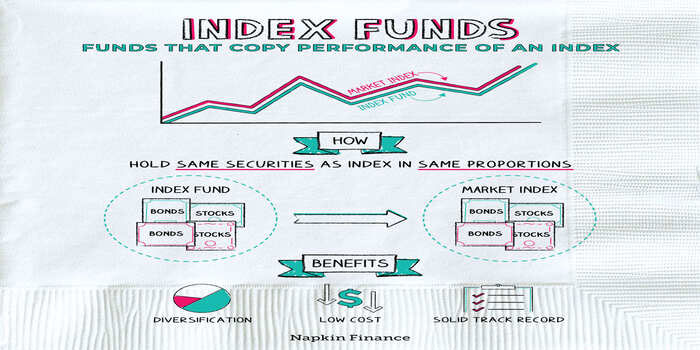

Top 3 Index Funds For Investors With A Long-Term Perspective

Explain in Detail: Why Invest In Index Funds?

Regulation E Guide: Fraud and Error Protection for Your Money

A Guide about Alliant Credit Union Personal Loans