National Debt Relief

Oct 25, 2023 By Triston Martin

National Debt Relief is a business that offers relief through the process of debt settlement. The goal of this process is to assist consumers in getting free of their debt. In the debt settlement process, you'll set the amount in a savings bank account each month until you can "settle" all your outstanding debts to pay less than you have to pay. Then, you'll be paying National Debt Relief a percentage of the debts they pay and only after you've seen results. The company claims that regardless of accounting for their costs, the customers can save 30 to 50 percent of the initial debt when the process is completed. A no-cost consultation will aid you in determining whether debt settlement is the right choice for you.

Types of Debt Addressed

National Debt Relief aims to assist consumers in paying off unsecured debt, which is all debt that isn't covered by collateral. It is good to know that the company offers a debt qualification page on their website, where they outline which debts qualify that do not meet the criteria. The most common types of debt they handle are listed below.

Credit card debt

If you are in credit card debt from a conventional credit card or retailer credit card, National Debt Relief can assist you in settling for less than what you are owed. This is the case for major credit cards such as American Express, Visa, or Discover and co-branded cards offered by retailers such as Kohl's and Sears.

Personal loan and payday loans

You may also negotiate and pay off any personal debts that you are facing, which includes personal loans from banks or online lenders or payday loans. Installment loans are also eligible.

Business debts

Business debts can be resolved through negotiations and at a lower rate than what you are owed now. National Debt Relief says these loans should be secured, and they would prefer to with debt negotiations for companies that have already been shut down.

Unpaid medical bills

National Debt Relief can also aid you in paying less than what you owe on your medical expenses. Negotiations can be completed successfully by working with hospitals, doctor's offices, and other medical professionals.

Back rent

If you're in debt on the rent you pay, you might be able to negotiate the amount due in arrears. However, you can negotiate the debt if you have ceased living in the same area.

Private student loans

It is also possible to settle debt linked with private loans to lessen the total amount. Be aware that Federal student loans don't allow debt settlement.

Client Onboarding

The first step to using National Debt Relief requires you to make an appointment for a complimentary consultation. In the meeting with a counselor for debt, we will discuss your financial situation and circumstances and find out the time frame for settling your debts and the amount you could save. National Debt Relief states that you must be owed at least $7500 to be eligible in their scheme. Also, you must not be "several months behind on your payments" because creditors don't have a reason to negotiate if you're current with your payments.

Customer Service

One advantage of working with a company that deals in debt relief is that they are familiar with the laws and regulations governing debt collection both inside and outside.

Company Reputation

The field of debt relief is not without plenty of scams to deal with. This is the reason it's crucial to research firms before signing up to use their services. One way to do that is to use the Consumer Financial Protection Bureau (CFPB) database and look up complaints from users of the debt settlement firms. The company is rated at 4.7 from 5-star ratings on more than 35,000 reviews from users on Trustpilot. Due to their outstanding reviews and rankings from third parties, National Debt Relief received one of the top scores for the company's reputation in our research study.

Cost

Its clients pay an average of 15% and 25 percent of the debt they have enrolled into their service. But, this fee is only due when results are reached and the debt has been resolved for less than the amount owed. In general, the fee percentage is comparable to the industry standard.

We decided to contrast the highly-rated National Debt Relief Accredited Debt Relief, the debt relief firm that earned the second-highest rating in our research study. Both received high ratings from Investopedia for their customer support, company reputation, charges, and services offered. They also provide the same program length of between 24 and 48 months. They also provide a complimentary consultation and costs that range from 15% and 25% of the amount you have paid off in debts.

How Does a USDA Loan Work

Types of Termination Letters and Essential Inclusions for Employers

Sears Shop Your Way Mastercard Review

Apple's Financials

Top 4 Best Commodity Trading Books Of 2022

Callable CDs: A Deep Dive Into This Unique Investment Option

Regulation E Guide: Fraud and Error Protection for Your Money

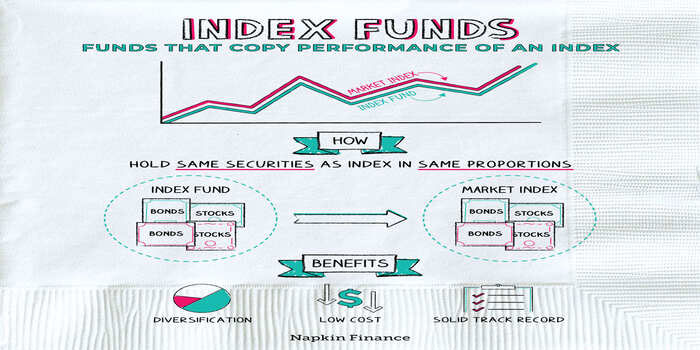

Explain in Detail: Why Invest In Index Funds?

How Construction Loans Can Finance the Home of Your Dreams

Prequalified vs. Preapproved: Learn the Difference

Interactive Brokers vs. TD Ameritrade: Understanding the Differences