Top 3 Index Funds For Investors With A Long-Term Perspective

Jan 01, 2024 By Triston Martin

A financial instrument or exchange-traded fund (ETF) that tracks a predetermined index of equities is called an index fund. The fund management or a third party, such as a financial institution or brokerage, may develop this index. This strategy involves fund managers not actively managing their funds but establishing a fund that closely resembles the index. As new firms are added, and old ones are dropped from the index, the fund's management will automatically reflect such changes in the fund's composition. In the financial headlines each night, investors may get updates on the performance of a number of the most followed indexes, frequently employed as a euphemism for the market.

Real Estate Exchange Traded Fund From Vanguard

It would appear that the Vanguard Property Investment ETF (NYSEMKT: VNQ) is a safe, low-cost option for anyone looking to invest in the international real estate market. It's also the largest real estate index fund, with total assets of about $86.30 trillion and an annual rate of 0.12%. All real estate investments in the United States are measured against the MSCI US Available to invest Market Asset Management 25/50 Index. The index primarily consists of equity property investment trusts (REITs), though it also includes some property investment management and development companies. The ETF's high exposure to REITs is one reason it is popular among income investors. The fund's dividend yield over the prior year was 2.45 percent as of May 2022 since the property is frequently considered a hedge against rising prices.

The S&P 500 Index Fund At Schwab

The Schwab Market Index Fund (NASDAQ MUDFUND: SWPPX) seems to be likely the least expensive choice for those wishing to invest in a fund that tracks the performance of the S&P 500 index. This transaction has a cost ratio of 0.02%, which translates to $0.20 per calendar year for every $1,000 invested. Due to the minimal investment fee, your returns have been almost on pace with the S&P 500's. So far, in 2021, the fund's total returns are 31.43 percent, which is quite close to the investment performance of the S&P 500. As of May 2022, the investment and the S&P 500 had lost around 16% of their value for the year. Because there isn't any minimum investment amount, even a single $1 will get you started.

Vanguard Growth Exchange Traded Fund

If you want to take on more investment risk in the hope of higher potential rewards, the Vanguard Development ETF (NYSEMKT: VUG) could be a good choice. The fund's performance is based on the CRSP US Mid Cap Growth Index, which tracks the S&P 500 Development Index. This ETF invests in 266 U.S. companies with large market caps experiencing rapid growth. The assets in the fund are broken down as follows: Divided between technology stocks (49.7%), consumer and investment stocks (24.3%), and manufacturing (10.3%), this portfolio is heavily weighted toward the former. The fund has only 0.9% of its value invested in the energy and utility industries. This ETF has a meager expense ratio of 0.04%. The fund's annualized return (pre-tax) over the past five years was 24.78 basis points as of Dec 31, 2021, easily beating the S&P 500's return of 15.26 percent.

Conclusion

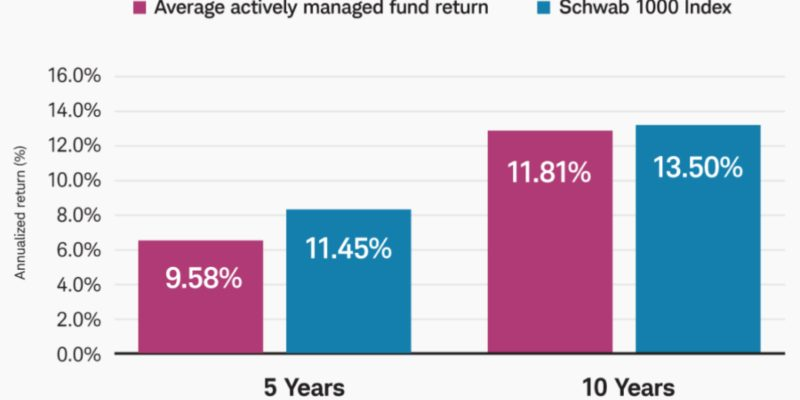

Index funds guarantee investors low-cost, transparent, and easy access to a diverse portfolio of assets. In my view, and the perspective of many of the world's top investors, especially Warren Buffett, actively managed funds are one of the safest investments a person can make. According to Buffett, a low-cost index fund is the best stock investment for most people. While index funds are excellent investments, some are better than others, and certain investors should stick to them rather than others. The three following financial institutions are my top picks for long-term investors. As a starting point, there is the Vanguard Total World Stock ETF (VT), which exposes its holders to the entire international stock investable universe. VT is a great investment option for the long term because of its very diversified assets and solid performance history.

What's A Fee-Based Investment?

Apple's Financials

Sears Shop Your Way Mastercard Review

How To Perform A Credit Check On A Potential Tenant

Way to Estimate Your FICO Score

Regulation E Guide: Fraud and Error Protection for Your Money

Prequalified vs. Preapproved: Learn the Difference

How Long Should You Live in a House Before Selling

Everything you Need to Know About Indirect Loans

Which Mortgage Type Should I Choose?

Interactive Brokers vs. TD Ameritrade: Understanding the Differences