Investing in The 10-Year U.S. Treasury Notes: Its Benefits and Phases

Dec 24, 2023 By Triston Martin

The US Treasury Department offers long-term investments in the 10-year Treasury Note. With a 10-year duration, this financial instrument pays investors interest biannually at the note's initial rate. Upon reaching its decade-long term, the US Government repays the face value of the note to the investor. The capital raised through these notes is crucial for the government, aiding in managing its debt and covering operational costs, including staff remunerations.

The 10-year Treasury note length distinguishes it from other government debt products. The Treasury Department also prints 2, 3, 5, and 7-year notes, but the 10-year note is the longest. Like its counterparts, it also provides semi-annual interest payments until maturity.

The 10-year Treasury note's interest rate provides a stable return and influences market rates. Treasury bond and mortgage loan interest rates are based on it. However, it's important to note that adjustable-rate mortgages are more influenced by the Federal Funds rather than this 10-year rate. When determining the Federal Funds Rate, the Federal Reserve considers the prevailing return rate of the 10-year Treasury note.

In financial analysis, the yield of the 10-year Treasury Note is often utilized as the standard for a risk-free rate. Methods like Weighted Average Cost of Capital (WACC) and Discounted Cash Flow (DCF) calculations clarify this point. These uses show its relevance to the wider financial and economic scene.

Purchasing 10-Year US Treasury Notes

Acquiring 10-year US Treasury notes involves participating in auctions, where investors can bid competitively or non-competitively. These notes are popular and reliable in the financial sector, making them a secure investment. The US has a debt-to-GDP ratio of 100%, yet market confidence is strong since the government is unlikely to fail. This trust makes the 10-year note an attractive option for many investors.

The US Treasury does not limit the holding term of these Treasury notes, thus investors may retain them until maturity or sell them. Unlike 2- to 7-year Treasury notes, which are released monthly, 10-year notes are only issued four times a year: February, May, August, and November.

10-Year US Treasury Note in Different Economic Phases

During a Recession

In times of market instability, the 10 year U.S. treasury bond often sees a surge in demand as investors gravitate towards more secure investment options. The selling of these notes at auctions by the US Treasury typically witnesses bids that match or exceed the note's face value. This trend is driven by investors' preference for secure places to park their funds, even though the returns, or yields, from these notes, tend to be lower during recessionary periods. This lower yield reflects the cautious approach of investors during economic downturns.

During an Expansion

Conversely, in the expansion phases of the business cycle, the demand for 10-year Treasuries usually declines. This shift is because investors seeking higher returns pay attention to more lucrative debt instruments. During these times, as the economic climate appears more robust and promising, investors are less inclined to settle for the modest returns offered by Treasuries. Instead, they seek alternative investment opportunities that promise higher yields, reflecting a greater appetite for risk in an improving economy.

Influences of Demand Variations on T-Notes

The interest rates of various debt instruments are closely tied to the demand for U.S. 10-year treasury note. When the market decreases, the yield on these notes tends to increase, leading to higher interest rates on long-term debts. This scenario particularly impacts debts not secured by the US Treasury, necessitating higher interest rates to offer investors a return compensating for the increased risk of default.

Strategies of the 10-Year US Treasury Note

In Financial Modeling and Corporate Valuation

Professionals across various financial sectors, such as investment banking, equity research, and corporate development, frequently use the 10-year Treasury Note's yield as the standard for a risk-free rate of return. This rate plays a crucial role in determining a company's Weighted Average Cost of Capital (WACC), where it's often employed as the benchmark for the 'risk-free rate' assumption in the cost of debt calculations.

Gauging Investor Confidence

The demand for the 10-year Treasury Note can be a barometer of investor confidence in the economy's performance. High confidence usually drives investors towards higher-yield investments, decreasing the demand and price of the 10-year T-Note. Conversely, low economic confidence boosts the demand for these more secure government-backed notes, elevating their price. This trend also influences the market values of riskier investments, which typically fall due to their increased default risk.

As an Economic Indicator

The yield on the 10-year US Treasury Note is a key metric investors in the United States watch. It helps them evaluate the economy's state by examining the Treasury yield curve, which graphically represents yields from short-term T-bills to long-term T-bonds. Positioned in the middle of this curve, the yield of the 10-year T-note is indicative of the return investors expect for a 10-year investment commitment.

Benefits of Investing in Treasury Notes

Portfolio Diversification

Treasury Notes, including the 10-year variant, offer valuable diversification in investment portfolios, as their returns are not directly correlated with stock market performances.

Safety of Investment

Regarded as one of the safer investment options, the U.S. 10-year treasury note often sees its price moving inversely to major stock market indices. During recessions, central banks typically cut interest rates, enhancing the appeal of older Treasuries with higher coupon rates than new issuances.

Tax Advantages

Investing in 10-year Treasury notes offers the benefit of exemption from state and local income taxes on coupon payments, although they remain subject to federal taxes.

No Minimum Holding Period

Investors can retain Treasury notes until maturity or sell them earlier in the secondary market without any mandatory holding period.

Purchasing T-Notes

The US Treasury offers 10-year notes and those with shorter maturities directly via the TreasuryDirect website, alongside T-bills and bonds. These can be acquired through competitive or noncompetitive bidding, starting with a minimum investment of $100 and subsequent $100 increments. Additionally, Treasury securities can be purchased through banks or brokers.

On this page

Purchasing 10-Year US Treasury Notes 10-Year US Treasury Note in Different Economic Phases During a Recession During an Expansion Influences of Demand Variations on T-Notes Strategies of the 10-Year US Treasury Note In Financial Modeling and Corporate Valuation Gauging Investor Confidence As an Economic Indicator Benefits of Investing in Treasury Notes Portfolio Diversification Safety of Investment Tax Advantages No Minimum Holding Period Purchasing T-Notes

Way to Estimate Your FICO Score

AmEx Gold vs. Platinum: Which Is Better for Your Business?

Regulation E Guide: Fraud and Error Protection for Your Money

Prequalified vs. Preapproved: Learn the Difference

How Does a USDA Loan Work

Apple's Financials

How To Get A Mortgage Refinance Even If You Have Bad Credit

How To Perform A Credit Check On A Potential Tenant

Top 4 Best Commodity Trading Books Of 2022

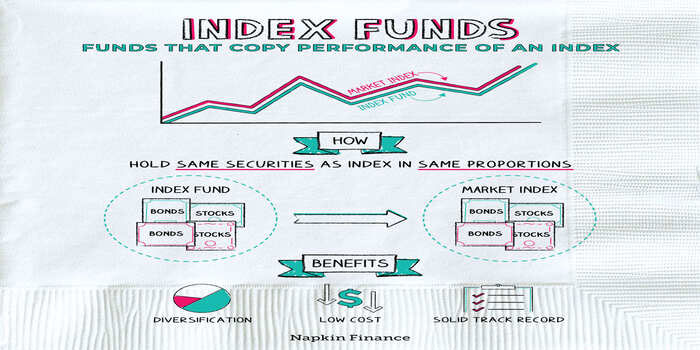

Explain in Detail: Why Invest In Index Funds?

National Debt Relief