Interactive Brokers vs. TD Ameritrade: Understanding the Differences

Jan 03, 2024 By Triston Martin

Introduction

The two brokers provide a wide choice of investment possibilities and have access to top-notch resources for tools and research. Because it offers fractional shares, which are still uncommon for brokers, Interactive Brokers separates from the competition. Additionally, Interactive Brokers provides access to Bitcoin, Ethereum, Litecoin, and Bitcoin Cash if you're interested in cryptocurrencies. Interactive Brokers is typically designed for more experienced traders rather than beginners because it is more challenging to use than competing websites.

TD Ameritrade vs. Interactive Brokers

Let’s consider: Interactive Brokers vs. TD Ameritrade! Although TD Ameritrade doesn't provide fractional shares or direct access to cryptocurrencies, there are crypto-based products available on the market for over-the-counter products, such as Grayscale Bitcoin Trust. For those just starting, it's a fantastic deal because more than 500 mutual funds on its platform have fees of 0.50 percent or less, and more than 1,000 have minimum investment requirements of under $100. Find out more about the brokers, then choose the one who would best meet your demands. The best option is Interactive Brokers for:

- Both seasoned and novice traders.

- The day traders.

- Accounts for margin.

- Dealing with options.

- Data and analysis.

- We abroad based investors.

Concerning Interactive Brokers

Since its founding in 1993, Interactive Brokers has been the leading option for experienced traders. However, in 2019, it developed IBKR Lite for retail investors, which includes individuals, trusts, joint owners, and retirement accounts. The IBKR Pro platform was created mainly for such clients.

For Interactive Brokers, a deposit must be at least $100. According to the business, customers who intend to invest in several portfolios or trade regularly are advised to make an initial investment of $25,000. In compliance with Securities and Exchange Commission (SEC) regular day trading standards, a minimum of $25,000 can aid in preventing the account from being locked.

Features of Interactive Brokers

Few brokerages offer as many goods, such as access to more than 266,000 funds. Customers can trade in more specialized categories like:

- Warrants

- Combinations

- Structured products

- Actual metals

- Between-commodity spreads

At the time of writing, there is also the opportunity to trade four different cryptocurrencies on the platform: Litecoin, Ethereum, Bitcoin Cash, and Bitcoin. TD Ameritrade, in contrast, opposes bitcoin trading. Additionally, the Traders' Academy at Interactive Brokers provides cost-free rigorous online training that includes tests. No matter how much experience you have with investing, this will help you improve your expertise.

Regarding TD Ameritrade

In 1975, immediately after the SEC eliminated commissions for fixed brokerages, TD Ameritrade was founded. Charles Schwab bought the business in 2019, although TD Ameritrade is still a separate offering. Along with investment alternatives, TD Ameritrade provides cash management services like online bill paying, credit and debit cards, and bill pay services.

Currency Trading

Regarding day trading, Interactive Brokers prevails over thinkorswim, while TD Ameritrade equalizes the playing field in the forex market. Unusual as it may be, the fact that two reputable brokerages offer Forex trading deserves to be praised. TD Ameritrade comes out on top in the end. Although Interactive Brokers offers 23 currency pairs, the Thinkorswim platform gives you access to more than 70.

Furthermore, unlike IB, TD Ameritrade does not charge a commission for trading foreign currencies. IB has a beginning minimum of $1 to $2 and charges a percentage of each trade. Although the platform is user-friendly, the absence or absence of the TD Ameritrade Forex commission makes it exciting and tempting. The interface is simple and gives each deal box numerous display possibilities.

Trading on Margin

You can find margin accounts at both brokerages. The costs do, however, vary greatly. IB will only be taxed a maximum of 1.59 percent on each balance, but TD Ameritrade margin rates are much higher. The highest percentage is 9.5 percent. The great Interactive Brokers function allows you to view the margin details, such as the initial and maintenance needs, for any ticker symbol you supplied. It's a nice feature that thinkorswim doesn't have.

Ease of Use

Now let's contrast the usability of TD Ameritrade and Interactive Brokers. It was long recognized for its user-friendly interface that makes it simple for beginners to start, TD Ameritrade. For more information, we suggest reading the TD Ameritrade review. So it's simple to open an account with TD Ameritrade, and you can do it using their website or mobile app on a laptop or mobile device. There are several different types of funds from which to choose. A "common types" area on TD Ameritrade helps you to focus your options and streamline the procedure.

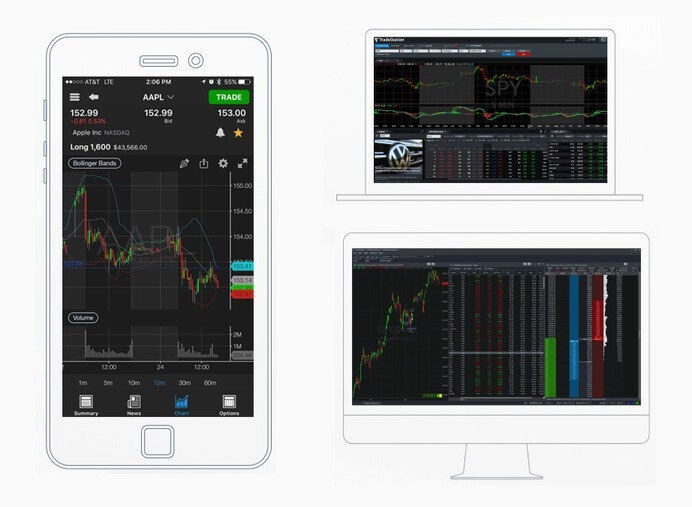

The good news is that IBKR has worked hard to simplify its onboarding process over the years and has made significant improvements. It is possible to open an account without immediately funding it. However, choosing from the several account types is more challenging. Regarding the trading platforms, Compared to Thinkorswim, using IBKR's Trader Workstation will require a steep learning curve. Additionally, changing your trade settings on IBKR can take a little longer.

Conclusion

Comparing the costs of trading FX and CFDs cannot be easy. Many brokers don't release information on average spreads and different pricing systems. Our thorough annual study shows Interactive Brokers provide traders with a better overall price. On ForexBrokers.com, we keep track of the locations of each broker's licenses in the forex and CFD markets across more than 23 regulator databases worldwide. We have gathered our findings. Interactive Brokers hold eight global Tier-1 licenses. TD Ameritrade owns TD Ameritrade has zero global Tier-2 licenses, while Interactive Brokers has one. TD Ameritrade and Interactive Brokers both scored the same Trust Score across fifty brokers, according to our analysis of 23 regulators from around the world.

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

What's A Fee-Based Investment?

Webull Review 2024: Free Trading App for Beginner and Pro Investors

How To Get A Mortgage Refinance Even If You Have Bad Credit

Difference Between Mortgage Lenders vs. Banks

Types of Termination Letters and Essential Inclusions for Employers

New Jersey Payroll Guide: Step-by-Step Teachings for Small Businesses

AmEx Gold vs. Platinum: Which Is Better for Your Business?

Callable CDs: A Deep Dive Into This Unique Investment Option

How Construction Loans Can Finance the Home of Your Dreams

Top 3 Index Funds For Investors With A Long-Term Perspective