How Does a USDA Loan Work

Dec 06, 2023 By Susan Kelly

Are you a first-time homebuyer looking for an affordable financing option to help make your real estate dreams a reality? If so, then a USDA loan may be the perfect solution.

The United States Department of Agriculture backs a USDA loan and can provide borrowers access to competitive interest rates and minimal down payment requirements. With generous requirements designed to assist low-income families in purchasing homes, it's no wonder why this type of loan has become increasingly popular among buyers.

So what exactly is a USDA loan, who qualifies for one, and how does it work? This blog post'll give you all the information you need to determine if this unique financial product is right for you!

What is a USDA Loan

A USDA or Rural Development Loan is a government-backed loan that assists low-income families in securing affordable home financing. It is backed by the United States Department of Agriculture (USDA) and provides access to competitive interest rates and minimal down payment requirements. The purpose of this type of loan is to encourage development in rural areas.

Types of USDA loans

There are three main types of USDA loans:

Direct Loans

Low-income families can get direct loans through the Single Family Housing Direct Home Loan Programme. Borrowers must satisfy specific eligibility standards, such as income caps that change depending on the size of the family and the area where the home is being purchased.

The program also offers financing for home repairs, which can be used in addition to the direct loan for purchasing a home or as an individual loan.

Guaranteed Loans

Guaranteed loans are available for moderate-income families through the Single Family Housing Guaranteed Loan Program. These loans provide greater flexibility regarding loan size and credit requirements, making them more accessible to a wider range of borrowers.

The program also allows borrowers to purchase existing homes, build new homes, or refinance an existing home loan.

Home improvement Loans

In addition to direct and guaranteed USDA loans, the department also offers a Home Improvement Loan program. This loan allows borrowers to make necessary repairs or improvements to their homes to make them more livable and energy efficient.

The funds can be used for any improvement, including new appliances, roof replacement, plumbing upgrades, remodeling, or anything else that can increase the value and safety of the property.

Benefits of a USDA Loan

With this loan, borrowers can receive competitive interest rates with minimal down payment requirements. Benefits of a USDA loan include:

Low Down Payment Requirements

One of the main attractions of the USDA loan program is its low down payment requirement. Borrowers are typically only required to pay 1 percent upfront, which allows them to conserve their cash for closing costs and other expenses associated with purchasing a new home. The remaining balance can be financed through the loan program itself.

No Private Mortgage Insurance (PMI)

Private mortgage insurance (PMI) is an added expense for buyers when applying for a traditional mortgage. A USDA loan eliminates the need for PMI, saving borrowers from this additional cost.

More Flexible Credit Requirements

USDA loans also have more lenient credit requirements than other loans, making it easier for potential homebuyers to qualify. The minimum credit score required is 620; however, some lenders may require a higher score to approve financing.

Do USDA Loans Have PMI

One of the primary benefits of a USDA loan is that it does not require private mortgage insurance (PMI). PMI typically adds hundreds of dollars to your monthly payment, so avoiding this cost can be beneficial.

Instead, USDA loans come with an upfront fee that acts as insurance for lenders in the event of default. This fee varies depending on the size of your down payment, but it is typically much lower than PMI.

How to Qualify for The USDA Loan

As many people can access these funds due to the USDA loan's flexible conditions, becoming eligible for one can be a terrific alternative for prospective homebuyers. Borrowers must meet specific income and credit requirements in order to be eligible for a USDA loan. The acquired property must also fulfil other requirements and be situated in an area that qualifies.

USDA Loan Requirements for Borrowers

To qualify for a USDA loan, borrowers must have an income at or below 115% of the median household income in their area. Income limits vary from county to county and state to state based on family size and location. In addition, applicants must demonstrate stable employment over the past 2 years and have a good credit history.

USDA Loan Requirements for the Property

The property must be in an eligible area to qualify for the USDA loan. These areas are primarily rural and suburban, though some parts of towns and cities can also qualify. The home must also be in good condition and meet certain standards the lender sets, including size limitations, age requirements, and more.

Additionally, vacancy rates in the area need to meet certain criteria and the property's availability of utilities such as water and sewer systems.

Once these requirements have been met, borrowers can apply for a USDA loan which offers competitive interest rates with no down payment required and low closing costs.

How to Apply for a USDA Loan

Research Eligibility Requirements

The first step in applying for a USDA loan is to determine if you are eligible. It would be best if you met certain income guidelines, were creditworthy, and were willing to live in a rural or suburban area designated as eligible for USDA financing.

Researching the eligibility requirements before starting your application will save you valuable time in the long run.

Collect Necessary Documents

Once you have determined that you are qualified for the USDA loan program, it's time to start collecting all the documents lenders require, such as tax returns, pay stubs, and bank statements. This document collection is an important step because it will demonstrate your ability to make payments on the loan now and down the road.

Choose a Lender

Selecting the right lender when applying for a USDA loan is important. A reputable lender will help you understand the process and provide you with services such as pre-qualification and pre-approval to make your experience easier from start to finish. Research lenders thoroughly and compare interest rates and terms before deciding.

Submit an Application

Once you have gathered all of the necessary documents, it is time to submit a loan application with your chosen lender. This application should include details about yourself, your current finances, and any assets that can help secure the loan, such as real estate or vehicles. Include as much information as possible to make the process smoother.

Get Approved

Once your loan application is submitted, the lender will review it, and you will be notified once a decision has been made. In many cases, approval comes quickly and with minimal paperwork or hassle. If approved, you will receive a commitment letter outlining the loan terms and any requirements to be met before closing the loan.

FAQs

Does USDA annual fee ever go away?

No, the USDA annual fee is a one-time fee that stays with your loan for its entire life. The purpose of this fee is to help offset costs associated with defaulted loans and maintain affordable rates on all loans across the program.

What are the benefits of obtaining a USDA loan?

Compared to other forms of real estate finance, USDA loans have many advantages. Low interest rates, no down payment, lenient credit standards, and lower monthly mortgage insurance costs are a few of them.

How do I qualify for a USDA loan?

To be eligible for a USDA loan, you must meet certain income limits based on your household size. Additionally, the property must be located in an area deemed rural or suburban by the USDA. Lastly, you must have an acceptable credit score and demonstrate steady sources of income.

Conclusion

Taking out a USDA loan is a great financial option for many Americans who need the means to take out a conventional loan. It will allow you to become a homeowner with an attractive, low-interest rate and pay minimal closing costs.

With no required down payment and the potential for lower interest rates with income limits, taking out a USDA loan can save you thousands of dollars in the purchase of your home. All in all, depending on your finances, it's worth considering a USDA loan when purchasing or refinancing your property.

On this page

What is a USDA Loan Types of USDA loans Direct Loans Guaranteed Loans Home improvement Loans Benefits of a USDA Loan Low Down Payment Requirements No Private Mortgage Insurance (PMI) More Flexible Credit Requirements Do USDA Loans Have PMI How to Qualify for The USDA Loan USDA Loan Requirements for Borrowers USDA Loan Requirements for the Property How to Apply for a USDA Loan Research Eligibility Requirements Collect Necessary Documents Choose a Lender Submit an Application Get Approved FAQs Does USDA annual fee ever go away? What are the benefits of obtaining a USDA loan? How do I qualify for a USDA loan? Conclusion

What's A Fee-Based Investment?

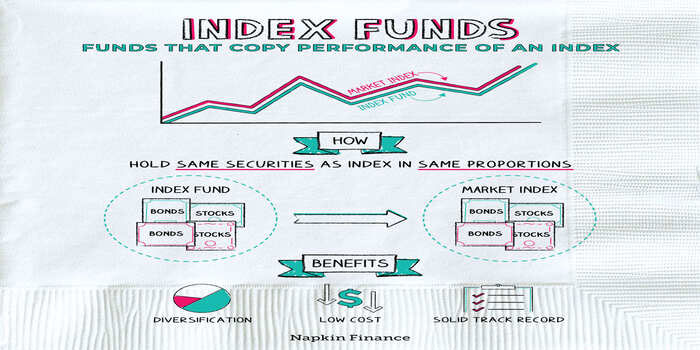

Top 3 Index Funds For Investors With A Long-Term Perspective

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

Explain in Detail: Why Invest In Index Funds?

A Beginner's Guide to Corporate Bonds: Definitions and Purchase Tips

Investing in The 10-Year U.S. Treasury Notes: Its Benefits and Phases

How Construction Loans Can Finance the Home of Your Dreams

How Does a USDA Loan Work

Difference Between Mortgage Lenders vs. Banks

Webull Review 2024: Free Trading App for Beginner and Pro Investors

Sears Shop Your Way Mastercard Review