Ways To Build A Bond Ladder To Boost Returns

Jan 02, 2024 By Triston Martin

Having the fundamental abilities, on the other hand, will eventually lead to more dependable results. Individual investors may better manage their cash flow by using a method known as a bond ladder, which seeks to reduce the risks often associated with investments in fixed-income instruments. Specifically, a bond ladder is a multi-maturity investing strategy that diversifies bond holdings within a portfolio. This approach tries to align cash flows with the demand for cash and to match cash flows with the demand for cash. When aging bonds are rolled over into other fixed-income securities all at once, this strategy lowers the reinvestment risk involved with the process.

Why Should You Use a Strategy Called a Bond Ladder?

The usage of the ladder technique is recommended for two primary reasons. First, if you spread out the dates of when the bonds will mature, you won't be tied down to any one bond for an extended period. One of the major drawbacks of tying up your money for an extended time in a single bond is that you cannot protect yourself from rising or falling bond markets. If you put your whole $50,000 savings into a single bond with a yield of 5% and a duration of 10 years, you would not be able to profit from changes in interest rates, regardless of which direction they moved in. By selecting bonds with varying coupon dates, you may ensure that you will get a monthly income depending on the coupon payments received from the laddered bonds. This relates to the initial investment of $50,000. This is of utmost significance for those already retired who rely on their assets' cash flows as their primary income source.

How to Create a Bond Ladder?

The actual construction of the ladder is a relatively straightforward process. Imagine a real ladder, complete with rungs and everything. The bond ladder approach may be considered a metaphorical version of a physical ladder.

Rungs

You can calculate the number of bonds for this portfolio or the number of rungs. This will give you the number of bonds that you will need. Your portfolio will be more diversified, and you will be better protected against the possibility of losing money due to the failure of a single firm to make bond payments according to the number of rungs on the ladder.

Height of the Ladder

The amount of time that elapses between the two different maturities of the bonds serves as the basis for the spacing between the rungs. This might be as infrequent as once every few months or as often as once every few years. Because bond rates tend to rise over time, it stands to reason that the longer you extend the duration of your ladder, the greater the expected rate of return on your whole portfolio should be. However, this increased return is canceled out by the danger of reinvestment and the inability to access the money.

Materials for Construction

In the same way, as actual ladders are constructed out of various materials, so can bond ladders. Investing in various businesses is a simple method that may be used to lessen one's vulnerability to risk. Nevertheless, depending on your requirements, investing in products other than bonds may be more beneficial. Debt obligations, municipal bonds, and bonds issued by the government

The ladder may be constructed from various investments, including Treasuries and certificates of deposit (CDs). Every single one of them has a unique set of advantages and disadvantages. Remember that the items that comprise your ladder should not be redeemed for cash by the entity that issued them. This is an essential point to keep in mind. A ladder with rungs that can be collapsed would be analogous to this situation.

Special Considerations

If you are going to employ the bond ladder approach, there are a few things you need to consider to determine whether or not it will be successful for you. You need to have sufficient funds to diversify your investments since the bond denominations that come with the highest possible returns are often the highest denominations available.

Regarding callable bonds, bond ladders don't function as effectively since interest payments might be stopped before the bonds reach maturity. Even under the most trying of circumstances, exercise patience. Also, fight the urge to cash in your bonds before they have reached their maturity date. If you want to cash in your bonds before the maturity date, there is no benefit in using a technique like this. This results in a greater distance between each rung due to the action.

Webull Review 2024: Free Trading App for Beginner and Pro Investors

The Sharing Economy

Way to Estimate Your FICO Score

Sears Shop Your Way Mastercard Review

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

AmEx Gold vs. Platinum: Which Is Better for Your Business?

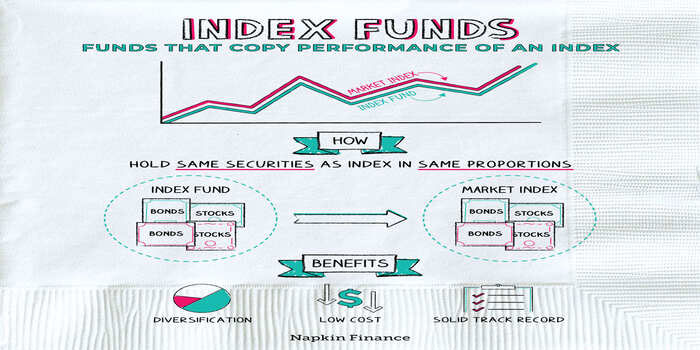

Explain in Detail: Why Invest In Index Funds?

Callable CDs: A Deep Dive Into This Unique Investment Option

New Jersey Payroll Guide: Step-by-Step Teachings for Small Businesses

How to Create a Roth IRA Backdoor

Prequalified vs. Preapproved: Learn the Difference