How To Get A Mortgage Refinance Even If You Have Bad Credit

Dec 12, 2023 By Susan Kelly

Can I Refinance With Bad Credit? You may be in luck if you have been putting off seeking to refinance your house loan owing to credit problems. Even if you have low credit, you may still be able to refinance your mortgage. Despite mortgage rates increasing at their fastest pace in a decade, you may be contemplating whether refinancing is still an option, even if your credit is less than perfect. Refinancing seems a good idea if you want to decrease your interest rate, take advantage of your home's value, or improve your financial situation. The answer is affirmative for many debtors who are looking to refinance. Let me explain. Some homeowners may be reluctant to refinance due to increases in their credit scores or negative marks on their credit history.

Why Should You Refinance?

Simply put, refinancing is getting a new mortgage to pay off an existing one. This is something you may do if, for example, you wish to switch to a different loan program with a special interest rate or if you want to cancel your mortgage insurance. (Unless you have 20% equity throughout your property, mortgage insurance is necessary whether you put just under 10% down or qualify for an FHA loan. Once you've refinanced, you may skip the premium payments altogether. A cash-out refinancing loan might provide you with a lump sum that can be used for anything from debt consolidation to property repairs. A refinancing loan application is quite similar to a mortgage loan application. You decide on a lender, make sure you qualify and submit an application. In most cases, you'll need to gather all relevant paperwork, such as pay stubs and bank records.

Can A Mortgage Be Refinanced With Terrible Credit?

The first step in the refinancing process is to get familiar with your credit score, and the requirements mortgage companies have for applicants. An excellent credit score is anywhere from 670 to 739, a good score is 580 to 669, and a bad score is already below 580. Standard mortgage refinancing usually requires a credit score of 620 or higher. You may qualify for a new FHA loan even if your credit score is in the mid-500s. Even if your credit isn't perfect, you may still be able to refinish your mortgage if property prices in your area have risen, thanks to the real estate bubble caused by the epidemic.

Bad Credit Refinancing

While a high credit score is necessary for most refinancing loans, other factors must be considered.

Apply Along with a Non-Occupying Co-Client

A non-occupying co-client who still doesn't currently reside in the property but is ready to accept the risk of becoming a co-borrower with you. A grandparent or parent fits this description. They guarantee that they will cover the debt if you cannot. Lenders consider your credit ratings and include your co-income client's when calculating your debt-to-income ratio when you have a co-client.

Apply for an FHA Streamline Refinance.

This choice may make it simpler to refinance an existing FHA loan. When applying for streamlined refinancing, you won't have to provide as much paperwork, may not need a fresh appraisal, and may even have lower eligibility criteria overall.

Refinance with a Cash-Out Option

If you want to refinance your mortgage and take some money out of it, you'll need a good credit score of 620 or above to be approved by most lenders. Home equity loans may consolidate debt provided you meet specific requirements. If your property is worth $230,000, however, you only have $185,000 left on your mortgage, you may very well be capable of refinancing into a loan for $200,000. It would eliminate your current loan and leave you with an extra $15,000. That would have been a significant boost to your financial status.

Conclusion

Since rates are so low, you might save money considering refinancing your mortgage. Like most people who increased their debt during the Covid-19 outbreak, your credit score may have taken a knock now. This may affect the interest rate and availability of mortgage refinancing. Refinancing a house when you have terrible credit requires extra effort, but it's not impossible. Refinancing is possible even with credit scores in the low 500s. Read on if you have adverse credit but need to refinance your mortgage.

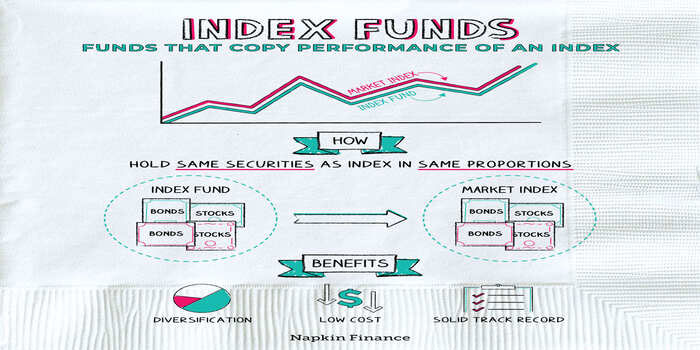

Explain in Detail: Why Invest In Index Funds?

How exactly does Eventbrite make money?

The Sharing Economy

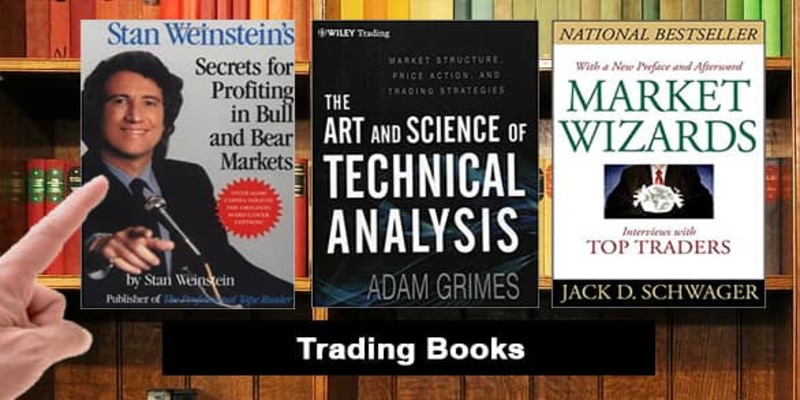

Top 4 Best Commodity Trading Books Of 2022

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

Everything you Need to Know About Indirect Loans

A Beginner's Guide to Corporate Bonds: Definitions and Purchase Tips

A Guide about Alliant Credit Union Personal Loans

What's A Fee-Based Investment?

Investing in The 10-Year U.S. Treasury Notes: Its Benefits and Phases

How Construction Loans Can Finance the Home of Your Dreams