Everything you Need to Know About Indirect Loans

Feb 09, 2024 By Triston Martin

When you start searching for loans, there can be a lot of different types that you might find in the market. Every kind of loan is beneficial in its own way and works differently. Among these different kinds of loans, we have indirect loans based on installments. One of the reasons why it is called an indirect loan is because the lender does not have a direct relationship with the borrower.

Understanding this type of loan is also very important if you want to apply for it. This is why we have compiled all the information you need. The article sheds light on different things related to the indirect loan, such as the definition, examples, and even the working. So, let's jump right into the article and look at it.

What is an Indirect Loan?

An indirect loan is a type in which there is no relation between the lender and the borrower. This means the lender won't communicate directly with the borrower and vice versa. Indirect loans are generally done through a third party with the intermediary's help. The intermediary is the person who will facilitate the lending process and look over the entire process.

This type of loan is also called the Dealer Financing loan. It is also seen that the loans trading in the secondary market also comes in the indirect loans. One of the main reasons people like getting direct loans is they enhance financial availability and reduce risk when applying for loans. It is also seen that people who do not qualify for direct loans can easily apply for indirect loans, and their applications will be accepted.

How Does an Indirect Loan Work?

There are a lot of companies that work on an indirect loan basis. Merchants, retailers, and even some dealerships with big-ticket items like cars, recreational vehicles, and other such things partner with third-party lenders so that the customers can get a loan and make their purchases based on financial installments. Two different companies are involved in indirect loans. One is the company offering the loans to the borrowers, and the other is selling the loan to the bank.

A dealer can originate the loan, and then it is bought by the bank, which will accept the buyer's loan. Once approved, the application will be forwarded to the dealer again, and they will let the borrower know if the application has been accepted or rejected.

This shows that the customer will be working with the dealer, who is the intermediary. They will be the ones who will run all the paperwork and ensure that the loan is approved, and the customer's dodo does not have to go to the bank themselves.

Common Examples of Indirect Loans:

For some people, this concept might not be easy to grasp. This is why we have an example to help you understand this concept. Auto dealerships are one of the most common examples of indirect loans. In some cases, the car loan is also called an indirect loan.

The dealerships often partner with third-party lenders. This allows them to give their customers an opportunity to get a loan and their favorite vehicle. While some people like getting loans directly from the banks, people who do not have a good credit score can opt for this route.

The best thing here is that they are easy to apply, and you don't have to do much hard work. This is because the clients themselves don't have to do anything. They just need to send their papers to the dealers, and they will do all the processes. Hence, this is a simple way to apply for the loan.

Another example is the secondary markets. This means that there is a pool of loans that are combined rather than individual loans. This often appears in the banks or even the credit union. They sell the loans to the consumer loans and the mortgages and sell them to lenders to acquire the new capital.

You will also see indirect loans in the home-lending market. They support the secondary trading of mortgages, so they have various loan programs. This makes it easy for customers to find their dream homes easily.

Pros and Cons of Indirect Loans:

With every kind of loan, there are some pros and cons. Below, we have mentioned the pros and cons of indirect loans.

Pros of Indirect Loans:

- The major pro of indirect loans is that they are very convenient for borrowers. This means if a person wants a car, they can easily buy the vehicle and finance the loan through the installment process.

- There are more opportunities for lenders when it comes to indirect loans. A wider pool of borrowers is trying to find good programs for indirect loans.

Cons of Indirect Loans:

- Whenever you get a loan, the major issue you might face is the interest rates. In this indirect loan, the interest rate is very high, making it a little risky for the borrowers. It is also seen that the dealership does not usually offer the best deals regarding this type of loan.

- Lenders have less control over the situation. They are not directly in contact with the borrowers, so they don't have control over the installment transactions; hence there are chances for fraud here.

Final Words:

The indirect loan is a type where the lenders and borrowers are not directly related. There is an intermediary or a third party who manages these loans. These loans can benefit individuals who do not have good credit scores and want to get something. This type of loan is commonly found in auto dealerships and secondary markets. Hence, we hope this article was beneficial for you in learning more about this type of loan.

Sears Shop Your Way Mastercard Review

A Beginner's Guide to Corporate Bonds: Definitions and Purchase Tips

Everything you Need to Know About Indirect Loans

A Guide about Alliant Credit Union Personal Loans

Interactive Brokers vs. TD Ameritrade: Understanding the Differences

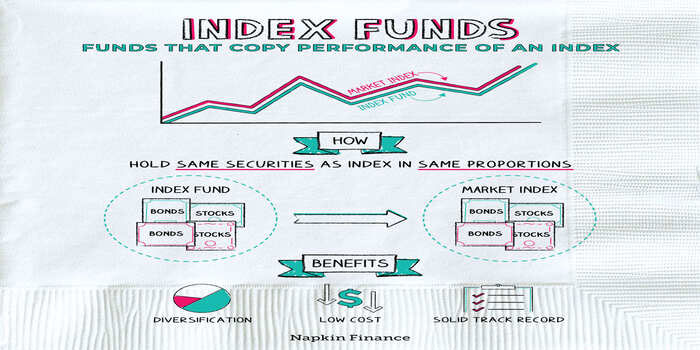

Explain in Detail: Why Invest In Index Funds?

Webull Review 2024: Free Trading App for Beginner and Pro Investors

How exactly does Eventbrite make money?

National Debt Relief

Difference Between Mortgage Lenders vs. Banks

How to Create a Roth IRA Backdoor