2024's Essential Guide to the 7 Best Invoicing Software for Small Businesses

Sep 01, 2024 By Vicky Louisa

In today's fast-paced business environment, effective invoicing is crucial for the success of small businesses. With numerous tasks vying for attention, having the right invoicing software can streamline processes, reduce errors, and ensure timely payments. This guide aims to illuminate the top seven invoicing software solutions tailored specifically for small business needs in 2024. Each software option offers unique features, user-friendly interfaces, and customizable templates to cater to diverse business requirements. Whether youre a freelancer managing your own accounts or a small business owner looking to simplify your billing system, finding the right tool can save you time and effort. Join us as we explore these essential tools, providing insight into their functionalities to help you choose the best fit for your business.

1. FreshBooks

FreshBooks is a highly regarded invoicing software that combines simplicity and powerful features, making it ideal for small businesses and freelancers. This cloud-based solution allows users to create personalized invoices quickly, track expenses efficiently, and automate recurring billing processes. With its intuitive dashboard, users can easily manage client information and payment statuses, ensuring a smooth invoicing experience.

FreshBooks offers time tracking and project management tools, allowing businesses to invoice clients accurately based on hours worked. The software also integrates seamlessly with various payment gateways, making it easy for clients to pay online, thus expediting cash flow for small businesses. With its affordable pricing plans and a free trial option, FreshBooks is an excellent choice for small businesses looking for a comprehensive invoicing solution.

2. QuickBooks

QuickBooks is another popular invoicing software that caters to small business needs. This cloud-based solution offers a range of features, including creating professional invoices, tracking expenses, managing inventory, and generating financial reports. QuickBooks also allows users to connect bank accounts and credit cards to track payments easily and reconcile accounts effortlessly. With its mobile app, users can manage their finances on the go, making it a convenient tool for busy entrepreneurs.

One standout feature of QuickBooks is its ability to handle multiple currencies and languages, ideal for small businesses with international clients. The software also offers various pricing plans to suit different business sizes and needs, making it a versatile option for small businesses looking for an all-in-one invoicing solution.

3. Wave

Wave is a free accounting and invoicing software designed specifically for small businesses with fewer than ten employees. This cloud-based platform offers features such as creating professional invoices, tracking expenses, managing receipts, and generating financial reports. One of the significant advantages of Wave is its user-friendly interface and simple navigation, making it an ideal choice for non-accountants or those new to accounting software.

With customizable invoice templates and automated recurring billing options, Wave makes managing invoices effortless for small business owners. The software also offers payment processing services, allowing clients to pay invoices directly through the invoice. With its free pricing model, Wave is a cost-effective option for small businesses looking for basic invoicing and accounting features.

4. Xero

Xero is a cloud-based accounting software that also offers invoicing capabilities for small businesses. This feature-rich platform allows users to create professional-looking invoices, track expenses, manage inventory, and handle payroll all in one place. The software integrates with over 800 third-party apps, making it easy to connect with other business tools and streamline processes.

One standout feature of Xero is its robust reporting and analytics tools, providing valuable insights into your business's financial health. The software also offers multi-currency support, making it suitable for small businesses with international clients. With its affordable pricing plans and a user-friendly interface, Xero is an excellent option for growing small businesses.

5. Zoho Invoice

Zoho Invoice is a cloud-based invoicing software that caters to small businesses looking for a straightforward and efficient invoicing solution. This platform offers features such as customizable invoice templates, automated recurring billing options, and time tracking capabilities. With its mobile app, users can manage their invoices on the go, making it convenient for entrepreneurs who are always on the move.

What sets Zoho Invoice apart is its integration with other Zoho apps such as Zoho CRM, Zoho Books, and Zoho Projects. This integration allows for a seamless flow of data between different business functions, making it an efficient choice for small businesses looking to streamline their processes. With its cost-effective pricing plans and a free trial option, Zoho Invoice is a suitable option for small businesses with basic invoicing needs.

6. Harvest

Harvest is another popular invoicing software that offers time tracking capabilities along with invoicing features. This cloud-based solution allows users to create professional invoices, track expenses, manage projects, and generate reports all in one place. The software also integrates with various third-party apps such as PayPal and Stripe, enabling smooth online payment options for clients.

One standout feature of Harvest is its project management capabilities, making it an excellent choice for businesses that need to track time and expenses for specific projects. The software also offers comprehensive reporting and analytics tools, providing valuable insights into your business's performance. With its affordable pricing plans and a free trial option, Harvest is a versatile invoicing solution for small businesses.

7. Invoice Ninja

Invoice Ninja is a free and open-source invoicing solution that caters to freelancers and small businesses. This platform provides users with the ability to create professional invoices, track payments, and manage client relationships all from a single dashboard. With customizable templates, Invoice Ninja allows businesses to tailor invoices to reflect their brand identity, enhancing professionalism in client interactions.

One notable feature of Invoice Ninja is its time tracking capabilities, enabling users to bill clients accurately based on hours worked. Additionally, it integrates with multiple payment gateways, making it effortless for clients to settle invoices online. Its flexible pricing model includes a free tier with essential features along with premium options for more advanced functionalities, making Invoice Ninja a great fit for a variety of small businesses seeking a straightforward and efficient invoicing solution.

Conclusion

In today's dynamic business environment, choosing the right invoicing software is crucial for small businesses aiming to improve efficiency and enhance financial management. Whether you opt for QuickBooks, Wave, Xero, Zoho Invoice, Harvest, or Invoice Ninja, each solution offers its unique set of features tailored to diverse business needs. By leveraging these tools, small business owners can streamline their invoicing processes, reduce administrative burdens, and ultimately focus more on growth and revenue generation. Selecting the appropriate software can provide not only convenience but also valuable insights into your business's financial health, ensuring that you remain competitive in your industry.

A Guide about Alliant Credit Union Personal Loans

Sears Shop Your Way Mastercard Review

Apple's Financials

A Beginner's Guide to Corporate Bonds: Definitions and Purchase Tips

How exactly does Eventbrite make money?

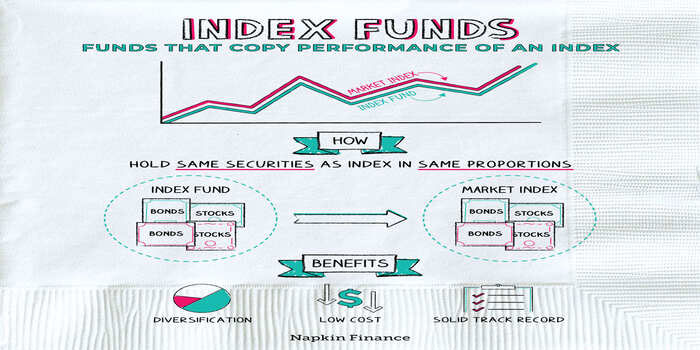

Explain in Detail: Why Invest In Index Funds?

Plan For Your Retirement With The 4% Rule

The Sharing Economy

TimeTrex 2024 Review: Is It the Right Workforce Management Tool?

How Does a USDA Loan Work

AmEx Gold vs. Platinum: Which Is Better for Your Business?